When it comes to investing in exchange-traded funds (ETFs), many investors find themselves grappling with the choice between VOO and VTI. These two popular ETFs, managed by Vanguard, cater to different investment strategies and goals. Understanding the nuances of each can significantly impact your investment portfolio. In this article, we will delve into a detailed comparison of VOO and VTI, exploring their features, performance, and the best use cases for each to help you make an informed decision.

The Vanguard S&P 500 ETF (VOO) focuses specifically on the S&P 500 index, comprising 500 of the largest U.S. companies. On the other hand, the Vanguard Total Stock Market ETF (VTI) offers broader exposure by including stocks of all sizes across the entire U.S. stock market. This key distinction is crucial for investors to consider as they align their investment choices with their financial goals.

In the sections that follow, we will provide a comprehensive analysis of VOO vs VTI, breaking down their performance metrics, expense ratios, dividend yields, and more. Whether you are a seasoned investor or just starting, this guide will equip you with the knowledge necessary to choose the right ETF for your investment strategy.

Table of Contents

1. Overview of VOO and VTI

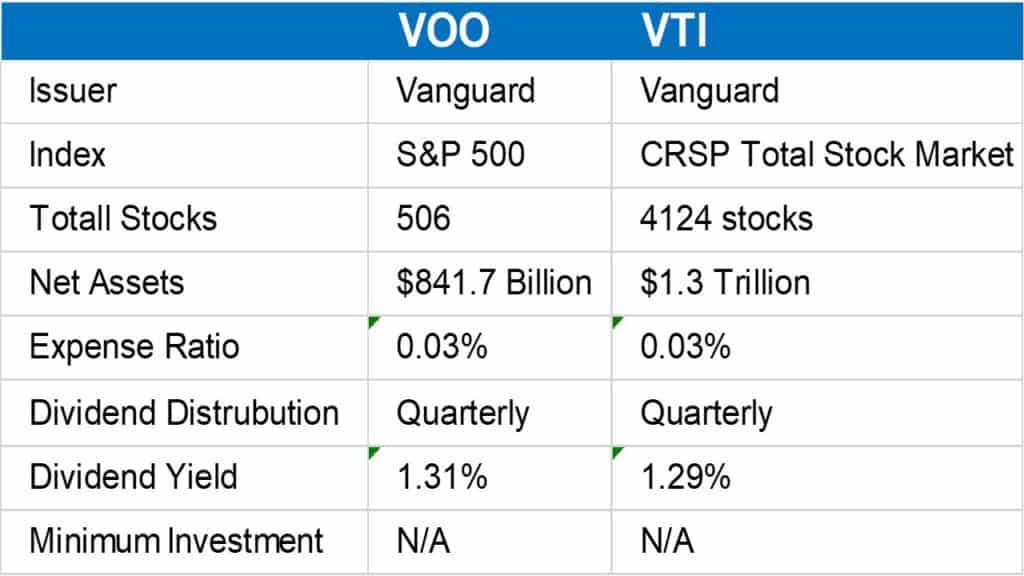

Both VOO and VTI are well-respected ETFs offered by Vanguard, but they serve different purposes within an investment portfolio. VOO tracks the S&P 500 index, while VTI encompasses the entire U.S. stock market, including small-cap, mid-cap, and large-cap stocks. This fundamental difference creates distinct investment opportunities.

1.1 What is VOO?

The Vanguard S&P 500 ETF (VOO) is designed to provide investors with exposure to the performance of the S&P 500 index, which is an indicator of the U.S. economy's health. This ETF includes a diverse range of large-cap U.S. companies across various sectors, making it a popular choice for those looking to invest in established companies.

1.2 What is VTI?

The Vanguard Total Stock Market ETF (VTI) aims to track the performance of the CRSP U.S. Total Market Index, which includes virtually all publicly traded U.S. companies. This ETF provides investors with a comprehensive view of the U.S. stock market, including small-cap, mid-cap, and large-cap stocks.

2. Performance Analysis

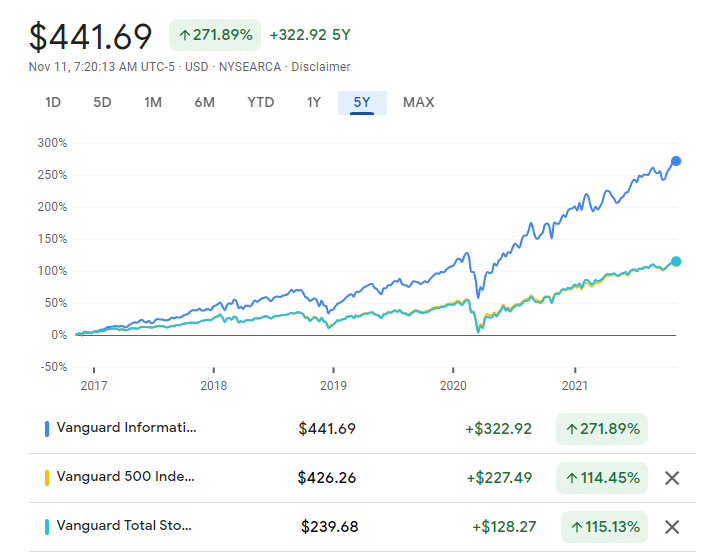

When comparing VOO and VTI, performance is a key consideration. Historically, both ETFs have provided strong returns, but there are notable differences in their performance metrics.

2.1 Historical Returns

Over the long term, VOO has consistently tracked the S&P 500, delivering average annual returns of around 10-15%. VTI, while also performing well, may have slightly different returns due to its inclusion of small-cap and mid-cap stocks, which can be more volatile but offer higher growth potential.

2.2 Volatility and Risk

VOO, being focused on large-cap stocks, tends to be less volatile than VTI. Small-cap stocks, included in VTI, can experience greater price fluctuations, which may appeal to risk-tolerant investors seeking higher returns.

3. Expense Ratios

Expense ratios are an important factor when selecting an ETF, as they can significantly impact long-term returns.

3.1 VOO Expense Ratio

VOO boasts a low expense ratio of approximately 0.03%, making it one of the most cost-effective options for investing in large-cap U.S. stocks.

3.2 VTI Expense Ratio

VTI also has a competitive expense ratio of around 0.03%, ensuring that investors retain a substantial portion of their returns.

4. Dividend Yields

Both VOO and VTI offer dividend payments, but their yields can vary based on their underlying holdings.

4.1 VOO Dividend Yield

VOO typically has a dividend yield of around 1.5%, providing investors with a steady income stream alongside capital appreciation.

4.2 VTI Dividend Yield

VTI generally offers a slightly higher dividend yield, closer to 1.7%, thanks to its broader exposure to dividend-paying stocks across all market caps.

5. Risk Factors

Understanding the risks associated with each ETF is crucial for making informed investment decisions.

5.1 VOO Risks

VOO's primary risk stems from its concentration in large-cap stocks, which can be more susceptible to macroeconomic changes and market fluctuations.

5.2 VTI Risks

VTI, including small-cap stocks, introduces additional volatility and risk. While small caps can offer higher growth potential, they can also be more sensitive to economic downturns.

6. Tax Efficiency

Tax efficiency is an essential consideration for investors, particularly those in higher tax brackets.

6.1 VOO Tax Efficiency

VOO is generally tax-efficient, with low turnover and a focus on capital appreciation. This can result in fewer taxable events for investors.

6.2 VTI Tax Efficiency

VTI also maintains tax efficiency, but its broader exposure may lead to slightly higher turnover and potential tax implications.

7. Who Should Invest in VOO or VTI?

Determining which ETF to invest in largely depends on your individual investment goals and risk tolerance.

7.1 Ideal VOO Investors

VOO is best suited for conservative investors seeking exposure to large-cap U.S. companies and lower volatility.

7.2 Ideal VTI Investors

VTI is ideal for investors looking for diversification across the entire U.S. stock market and those willing to accept higher volatility for potential growth.

8. Conclusion

In summary, both VOO and VTI have their unique advantages and cater to different investment strategies. VOO offers a focused approach to large-cap U.S. stocks, while VTI provides comprehensive exposure to the entire U.S. stock market. By considering your investment goals, risk tolerance, and desired level of diversification, you can make an informed choice between these two ETFs.

We encourage you to leave your comments or questions below and share this article with fellow investors. For more insights and articles on investment strategies, don't hesitate to explore our website further!

Thank you for reading, and we look forward to seeing you again for more valuable investment information!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9Oop6edp6h%2Bd3vVqKZmrqNiw7W1jaGrpqQ%3D